Navigating what can you put in a prenup? Prenups can include a variety of provisions from asset division to spousal support, but there are exclusions to be mindful of for legal compliance. Our guide takes you through the ins and outs of crafting a prenup that’s both protective and permissible.

Prenuptial agreements outline the division of assets and debts, protecting financial interests and ensuring both parties are on the same page before marriage.

Key prenup inclusions cover separate and community property, debts and liabilities, spousal support, and preserving family assets and interests for children from previous relationships.

Getting professional legal assistance is crucial for drafting an enforceable prenup that meets all legal requirements and protects both parties’ rights.

Picture this: prenuptial agreements, also known as premarital agreement or prenups, as your own personal financial bodyguard. They’re contracts entered into before marriage, and their main goal? To establish guidelines for splitting assets and debts if your marriage ends in divorce, especially if there’s a substantial disparity in wealth between the partners. It’s not about being pessimistic about your future together. It’s about being pragmatic and prepared.

They’re not just for the rich and famous either. When preparing for marriage, a prenup can be established with the mutual agreement of both individuals. It ensures that both parties consent to its terms before entering into the union. Prenuptial agreements don’t just protect assets; they protect a variety of financial interests. However, they do have their limitations, especially when it comes to personal preferences that can be included.

A prenuptial agreement is a contract between two people about to get hitched. It outlines property, debts, and property rights during the marriage and in case of divorce or death. Think of it as your financial roadmap. It’s there to guide you through the complex landscape of marital finances and ensure that your individual assets and financial interests are protected with your own prenuptial agreement, also known as a prenup agreement.

How does it do this? By stipulating in advance how property should be divided, thereby preempting potential court involvement if the marriage ends. It’s like having a Plan B – it doesn’t mean you expect things to go wrong, but it sure does help navigate the storm if they do.

Navigating the legal maze of prenuptial agreements can be challenging. The enforceability of a prenup is contingent upon it being entered into freely and voluntarily, with both parties understanding the terms and implications. You might think drafting a prenuptial agreement without a lawyer is the cost-effective route, but it may risk the agreement being unenforceable due to non-compliance with statutory requirements.

That’s where a family law attorney and matrimonial lawyers ride to the rescue. They play a critical role in drafting and reviewing a prenuptial agreement to ensure it will hold up in court and that both parties’ wishes are respected. But remember, complete, full, and accurate disclosure of income, assets, and debts is required from both parties.

To ensure a fair and valid prenuptial agreement, each partner should have independent legal representation to prevent enforcement issues like coercion or unfair terms that may arise if one or both parties lack proper counsel.

Now that we’ve covered the basics, let’s talk about the key elements that make up a prenuptial agreement. A prenup often defines property and income as separate to avoid adhering to community property laws in a divorce and predetermines how these will be divided. It’s like having your own personal financial manual to simplify the division of finances during divorce.

Financial disclosure of assets, liabilities, and income is mandatory in a prenup. However, don’t think you can include just anything in a prenuptial agreement. There are certain things, like household duties, that might violate public policy and must be excluded. In California, a prenup cannot promote divorces or it will be held unenforceable for violating public policy.

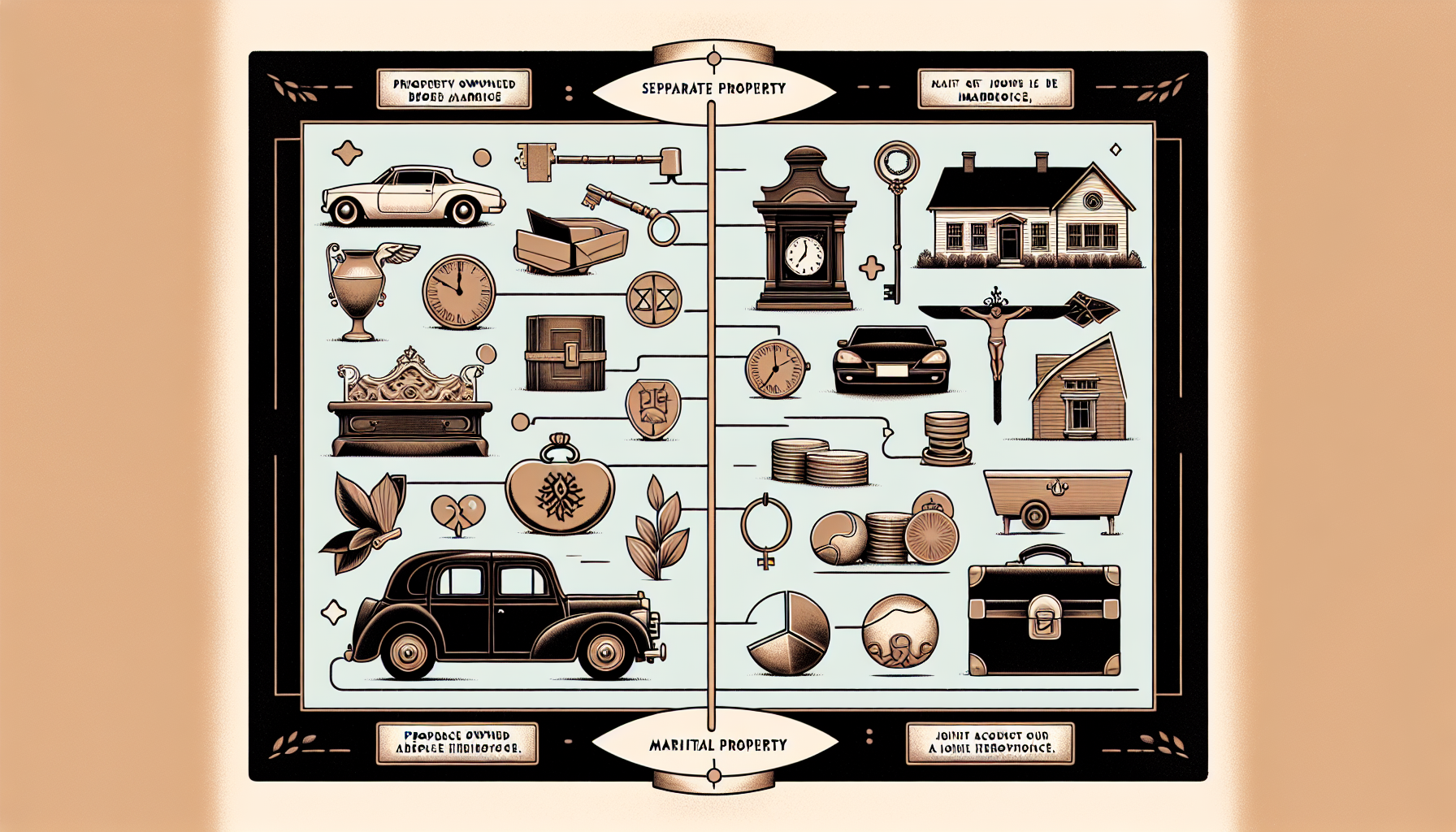

Separate property and Community property – these two categories play a pivotal role in a prenuptial agreement. Separate property consists of assets owned before the marriage as well as those acquired through a gift or inheritance. These assets, including a spouse’s separate property, are not typically considered part of the community estate. Assets acquired during the marriage, or marital assets, are referred to as community property. This includes any property acquired by either spouse during the course of the marriage.

Prenuptial agreements serve to:

Identify each spouse’s separate property to ensure it remains protected upon divorce

Identify specific and intentional ways community assets and incomes can be created during the marriage.

Stipulate the division of community estate in advance

Override default rules in community property states, where assets obtained during marriage are owned jointly by default.

Include clauses that phase in separate property, changing its classification from separate to marital property after certain milestones in the marriage

Believe it or not, a prenuptial agreement can be your financial shield when it comes to the debt of your spouse. It can limit debt liability, safeguarding a spouse from being held responsible for the other spouse’s pre-existing debts, such as student loans.

Prenuptial agreements should stipulate the handling of individual and marital debts, clarify responsibility for debt repayments, and provide protection from creditors for debts incurred by the other spouse. It’s all about making sure everyone is on the same page about financial responsibilities, even those that involve a stay-at-home parent.

Spousal support and alimony may seem like topics reserved for the divorce court, but they can also be addressed in a prenuptial agreement. This can include provisions for spousal support to address disparities in income and assets between spouses, preventing contentious disputes during divorce proceedings.

Prenups can stipulate waivers or set limitations on spousal support, understanding that certain provisions may be influenced by state laws and judicial discretion regarding fairness. Alimony terms can even be precisely defined in a prenuptial agreement, specifying exact amounts, durations, or conditions, unless such terms risk leaving a spouse in significant financial hardship after divorce.

Prenuptial agreements aren’t just about protecting individual interests. They also play a significant role in safeguarding family assets and interests. If you have children from previous relationships, a prenup can ensure that your family assets are well-protected in the event of a subsequent marriage.

These agreements serve as a strategic tool for designating certain assets for the children from these previous relationships, separate from any marital property. This is done through mechanisms such as trusts or specific asset allocations to ensure that designated assets are preserved for those children. By securing assets for children from prior relationships through a prenup, the long-term welfare of the family is supported, reflecting a comprehensive approach to asset protection and child custody in blended family scenarios.

With a prenuptial agreement, you can plan for the future and leave a legacy without worry. Prenups can:

Specify which assets and future inheritances are considered separate property.

Enable individuals to protect the rights of their children from previous relationships to inherit specific assets.

Include clauses that detail the distribution of assets upon a spouse’s death, and can clearly state how they interact with and potentially take precedence over wills or trusts.

In essence, prenuptial agreements:

Facilitate the redirection of estate distribution according to personal wishes

Safeguard generational wealth

Detail spousal rights after the death of a partner.

Can incorporate estate planning vehicles to protect both spouses should one predeceases the other.

Children from previous relationships and previous marriage deserve protection too. Prenuptial agreements can include provisions specifically for these children. For instance, a prenup can specify certain assets, such as property or investments, that will be set aside specifically for the children from a previous relationship after the death or divorce of a parent.

Educational trusts can be established within a prenup as a way to secure a child’s future education costs. Life insurance policies with children from a previous relationship as designated beneficiaries can provide financial security. Additionally, prenups can include mechanisms such as trusts to minimize disputes and ensure that the children from previous relationships receive their allocated assets without conflict.

Prenuptial agreements aren’t just about personal assets and liabilities. They also address business and career considerations. A prenuptial agreement can provide a business owner with full discretion over the management and future decisions regarding their business, regardless of marital status.

Prenups can include specific clauses that ensure the continuity of a business, managing how income and financial benefits are distributed post-divorce. They can also safeguard intellectual property rights, which can be a significant asset in certain careers.

If you’re a business owner, a prenuptial agreement can be a lifesaver. Prenups can specify that the business interests and assets owned by one spouse before marriage are considered separate property, thereby ensuring that the original owner retains control during marriage and post-divorce.

Business interests, including any rise in value they experience during the marriage, can be protected through specific clauses in prenuptial agreements. They can also outline the expectations for how future business property will be owned and managed, defining whether it will be owned jointly or separately. With the right provisions for the valuation of business assets and the terms for buyouts, a prenup can be a vital tool for business owners.

Prenuptial agreements also consider non-monetary contributions in a marriage, such as the role of a stay-at-home parent. They can facilitate financial growth and independence for stay-at-home parents by having the earning future spouse contribute to a separate bank account for the non-earning spouse.

Stay-at-home parents can have alimony stipulations included in the prenup, which provides a safeguard and ensures financial support if the marriage dissolves. Compensation for stay-at-home parents in prenups may include a lump sum payment upon divorce, recognizing the economic value of career sacrifices and aiming to equalize wealth.

Legal guidance is more than just a choice; it’s a necessity when it comes to drafting a prenuptial agreement. Legal guidance is crucial for creating a prenuptial agreement that adheres to state laws and is legally enforceable. Attorneys assist in ensuring:

Clear term outlines

Full disclosure of all financial assets and liabilities

Thoroughness and tailoring to the couple’s unique circumstances

Protection of their rights

It’s strongly advisable for both partners to have independent legal counsel to guarantee an understanding of the prenup’s legal implications and to confirm its equitable nature.

In the end, a prenuptial agreement isn’t a prediction of divorce or a manifestation of distrust; it’s a practical tool for safeguarding your future. It’s about ensuring that, should the unexpected happen, both parties and their interests are protected, thereby facilitating a smooth journey through an otherwise tumultuous time. Consider it less of a romance-killer and more of a future-maker.

You cannot include child support and custody in a prenup. These matters are determined by the court, prioritizing the child’s best interests.

A prenuptial agreement can protect family assets and interests by specifying certain assets for children from previous relationships and safeguarding their inheritance rights, separate from marital property. This ensures that family belongings are safeguarded and passed down accordingly.

A prenuptial agreement can protect business owners by specifying that their business interests and assets remain separate property, ensuring their control and protecting any increase in value during the marriage. This helps safeguard their business in the event of a divorce.

Yes, a prenuptial agreement can compensate a stay-at-home parent by including provisions for financial support, such as contributions to a separate bank account and alimony stipulations. This can provide a safeguard and ensure financial growth and independence in case of divorce.

Comments

No Responses to “Tailoring Your Future: What Can You Put in a Prenup for a Smooth Marriage Journey”

No comments yet.